Maximize Your Payroll Workflow-- Contact CFO Account & Services for Payroll Services

Maximize Your Payroll Workflow-- Contact CFO Account & Services for Payroll Services

Blog Article

Browsing the Intricacies of Payroll Solution: A Total Guide for Entrepreneurs

As entrepreneurs endeavor right into the realm of handling their businesses, the details of payroll services often provide a maze of difficulties to browse. From figuring out pay-roll tax obligations to making sure conformity with wage legislations, the journey can be frustrating without a thorough guide. One mistake in handling pay-roll can lead to expensive effects for a burgeoning service. In this full overview customized for entrepreneurs, we decipher the complexities of pay-roll solutions, supplying insights and techniques to enhance procedures and make notified decisions. Join us on this trip to untangle the intricate world of pay-roll management and empower your service for sustainable growth and success.

Recognizing Pay-roll Taxes

Employers must properly compute and keep the appropriate amount of taxes from staff members' paychecks based on variables such as income degree, filing condition, and any allocations claimed on Kind W-4. Additionally, businesses are accountable for matching and paying the ideal section of Social Security and Medicare tax obligations for each staff member.

Understanding pay-roll taxes entails staying current with tax regulations and guidelines, which can be complicated and subject to alter. Failure to abide by payroll tax obligation requirements can cause costly charges and penalties for services. Therefore, services should guarantee they have the expertise and processes in location to handle pay-roll tax obligations precisely and successfully.

Selecting the Right Pay-roll System

Navigating pay-roll services for business owners, especially in understanding and managing payroll tax obligations, highlights the vital significance of choosing the right pay-roll system for reliable economic operations. Picking the ideal payroll system is essential for organizations to improve their payroll processes, make certain conformity with tax obligation regulations, and keep accurate economic documents. Entrepreneurs have numerous alternatives when it concerns selecting a pay-roll system, ranging from manual methods to sophisticated software program remedies.

When making a decision on a payroll system, entrepreneurs need to take into consideration variables such as the size of their service, the intricacy of their payroll needs, budget restrictions, and the degree of automation wanted. Local business with uncomplicated pay-roll demands may choose for basic payroll software application or outsourced payroll services to manage their payroll jobs successfully. In comparison, bigger enterprises with more complex pay-roll structures may gain from sophisticated pay-roll platforms that use functions like automatic tax obligation estimations, direct deposit capabilities, and integration with bookkeeping systems.

Inevitably, the secret is to pick a pay-roll system that straightens with the service's particular demands, enhances operational effectiveness, and guarantees timely and accurate pay-roll processing. By picking the ideal payroll system, entrepreneurs can effectively manage their payroll duties and concentrate on expanding their services.

Conformity With Wage Regulations

Making sure compliance with wage regulations is a fundamental aspect of preserving lawful honesty and moral criteria in organization operations. Wage regulations are designed to shield employees' civil liberties and make certain fair payment for their work. As an entrepreneur, it is essential to remain educated about the specific wage laws that relate to your business to prevent potential lawful concerns and economic fines.

Trick factors to consider for conformity with wage laws include sticking to base pay needs, precisely categorizing staff members as either non-exempt or exempt from overtime pay, and making sure prompt repayment of salaries. It is also important to keep up to day with any adjustments in wage regulations at the government, state, and regional degrees that might impact your more helpful hints organization.

To efficiently navigate the complexities of wage laws, consider applying pay-roll software program that can help automate estimations and make certain precision in wage payments. In addition, looking for assistance from lawyers or human resources experts can provide important insights and support in keeping conformity with wage laws. Contact CFO Account & Services for payroll services. By focusing on conformity with wage regulations, entrepreneurs can produce a structure of depend on and fairness within their companies

Simplifying Pay-roll Processes

Effectiveness in handling payroll procedures is vital for entrepreneurs looking for to enhance their business procedures and guarantee exact and timely payment for workers. One reliable means to simplify pay-roll is by spending in pay-roll software application that can streamline all payroll-related data, automate estimations, and create records perfectly.

Furthermore, outsourcing payroll services to a trusted company can better enhance the procedure by offloading jobs to experts who specialize in pay-roll management, enabling business owners to focus on core business activities. By improving payroll procedures, entrepreneurs can improve efficiency, accuracy, and compliance in managing worker payment. Contact CFO Account & Services for payroll services.

Outsourcing Pay-roll Services

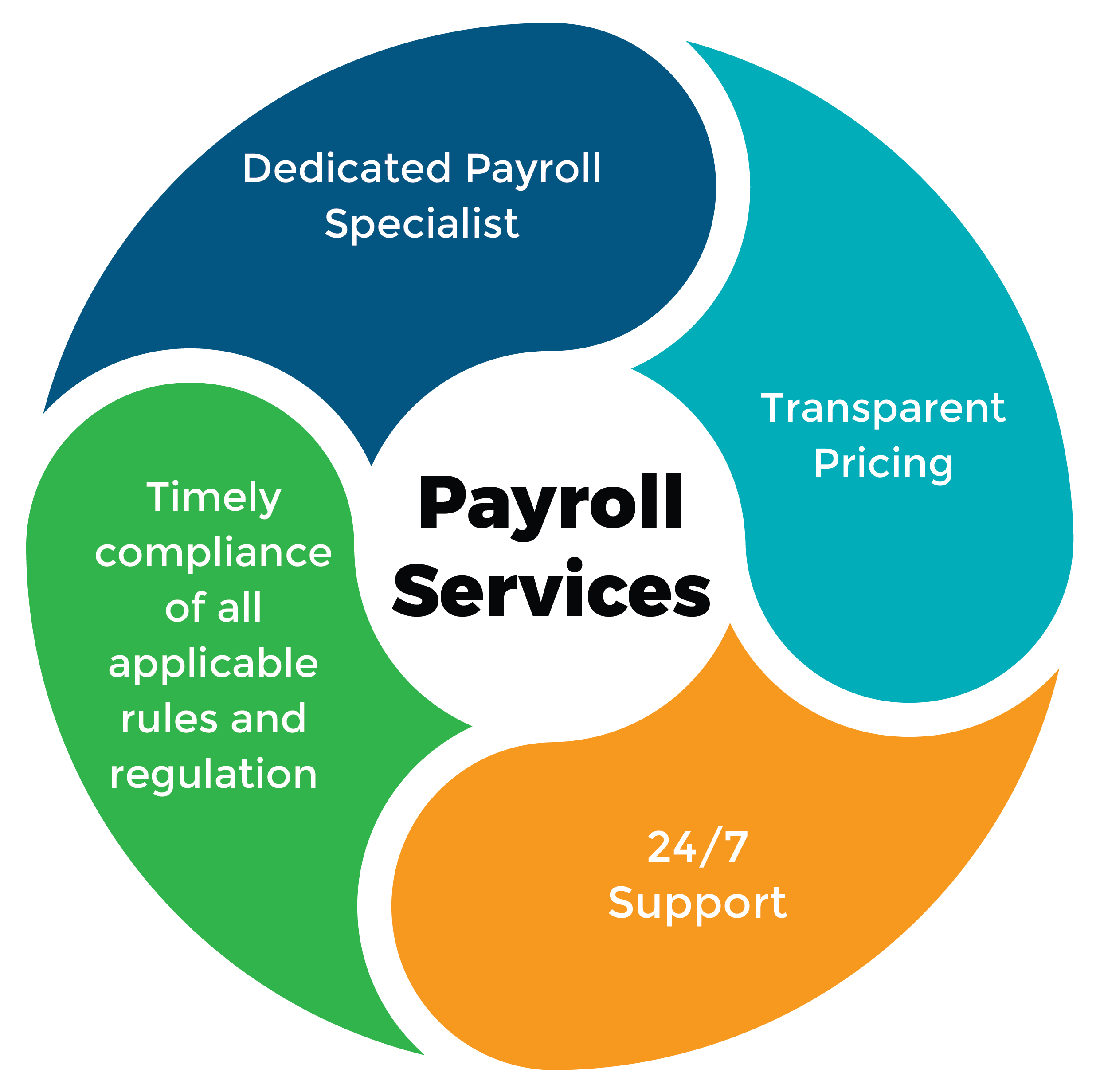

Considering the intricacy and time-consuming nature of payroll management, several business owners opt to contract out pay-roll solutions to specialized providers. Outsourcing pay-roll services can use many benefits to services, including price financial savings, boosted precision, compliance with tax obligation guidelines, and freeing up useful time for entrepreneurs to concentrate on core company tasks. By partnering with a credible payroll company, official source entrepreneurs can ensure that their workers are paid precisely and on time, tax obligations are calculated and filed appropriately, and payroll data is firmly taken care of.

Verdict

In verdict, browsing the complexities of payroll solution needs a detailed understanding of payroll taxes, picking the appropriate system, sticking to wage legislations, maximizing procedures, and possibly outsourcing services. Business owners should carefully take care of payroll to make certain conformity and performance in their organization operations. By complying with these standards, business owners can efficiently handle their payroll obligations and focus on expanding their service.

Report this page